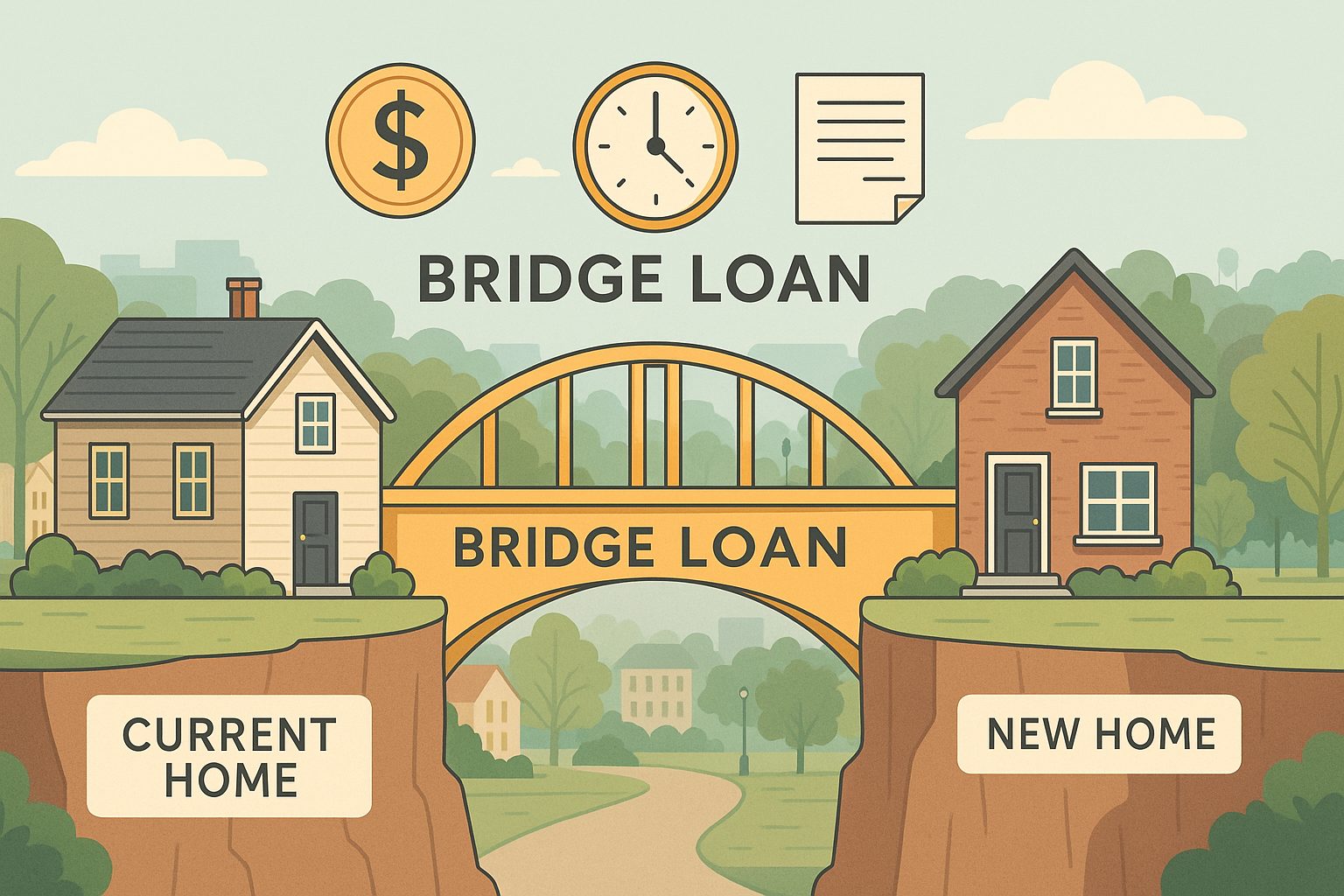

In Michigan’s real estate market, bridge loans serve as a valuable short-term financing option designed to help homeowners and investors navigate transitions between property ownership. Essentially, they “bridge the gap” when you need to purchase a new home before you’ve sold your current one.

How they work:

- Utilizing Current Home’s Equity: Bridge loans use the equity built up in your current home as collateral to provide funds for a down payment and closing costs on your new property.

- Short-Term Solution: These loans are typically intended for a short duration, usually ranging from six months to a year, or even a shorter period like 90 days, depending on the lender.

- No or Flexible Payments (During Transition): Some lenders in Michigan offer bridge loans with no monthly payments for a certain period (e.g., up to 6 months), with the entire loan being repaid when your current home sells. Others might require interest-only payments.

- Non-Contingent Offers: By using a bridge loan, you can often make a non-contingent offer on your new home, making your offer more appealing to sellers in a competitive market.

Potential Benefits:

- Buy before you sell: This is the primary advantage, allowing you to secure your new home without the pressure of having to sell your current one first.

- Increased buying power: The equity unlocked from your current home can provide a larger down payment on the new property.

- Smooth transition: A bridge loan can reduce the stress and logistics associated with a simultaneous sale and purchase.

- Potential to avoid PMI: If the bridge loan helps you make a 20% down payment on your new home, you may not need to pay private mortgage insurance (PMI).

Potential Drawbacks:

- Higher interest rates: Bridge loans generally come with higher interest rates compared to traditional mortgages.

- Fees and closing costs: Expect various fees, such as origination fees, appraisal costs, and closing costs, which can increase the overall cost of the loan.

- Financial pressure: Managing payments for two homes (your current mortgage and the bridge loan) can be financially challenging, especially if your current home takes longer to sell than expected.

- Equity requirements: Most lenders require a minimum amount of equity in your current home (typically at least 20%, but sometimes more).

Lenders in Michigan:

Several financial institutions and private lenders in Michigan offer bridge loans. Some examples include:

- Banks and Credit Unions: Michigan First Credit Union and Arbor Financial Credit Union are mentioned as offering bridge loans.

- Mortgage Lenders: Treadstone Mortgage specializes in bridge loans for Michigan homeowners.

- Hard Money Lenders: These lenders are an option for real estate investors and can provide bridge financing, though often at higher rates.

To qualify for a bridge loan in Michigan, you generally need sufficient equity in your current home (typically at least 20%), a qualifying income, and a good credit history. Lenders will also assess your plan to sell your current home and repay the bridge loan.

Before deciding on a bridge loan, it’s important to compare offers from different lenders, carefully review the loan agreement, and consider consulting with a financial or real estate professional to determine if it’s the right option for you. Keep in mind that specific terms and eligibility can vary by lender.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link